The Psychology of Money

Book by Morgan Housel

3 Sentence summary

Morgan Housel emphasizes that financial success is not just about earning money, but about managing it wisely.

He argues that the skill to handle money effectively—through budgeting, investing, and making prudent decisions—is more crucial than simply generating income.

This approach underscores the importance of financial discipline and thoughtful management.

“Doing well with money isn’t necessarily about what you know. It’s about how you behave.”

“No one is crazy. Everyone makes decisions based on their own unique experiences that seem to make sense to them in a given moment.”

“Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

“The most important part of every plan is planning on your plan not going according to plan.”

“Wealth is what you don’t see. It’s the cars not purchased, the clothes not bought, the jewelry forgone, the first-class upgrade declined.”

“Controlling your time is the highest dividend money pays.”

“The ability to do what you want, when you want, with who you want, for as long as you want, pays the highest dividend that exists in finance.”

“There is no reason to risk what you have and need for what you don’t have and don’t need.”

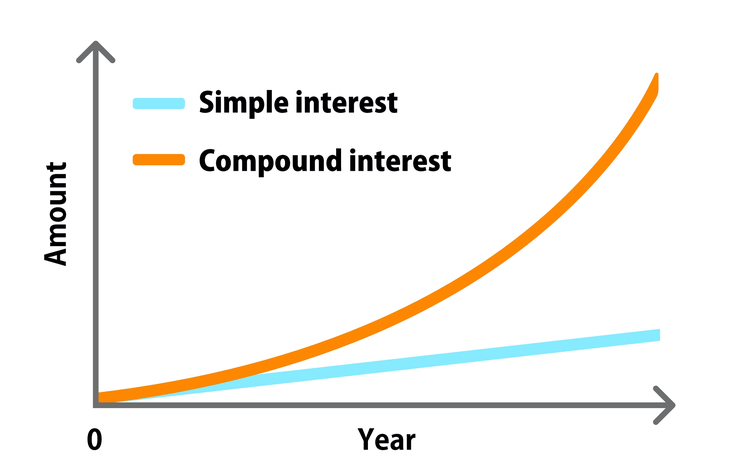

“Compounding is the most powerful force in finance, but it only works if you can give it time to grow.”

“Getting wealthy and staying wealthy are two different skills.”

Behavior Over Knowledge: Success with money is more about behavior than technical knowledge. Good financial decisions are driven by discipline, patience, and self-control rather than just understanding numbers or strategies.

Compounding Power: Compounding is one of the most powerful forces in finance. Small, consistent investments over a long period can lead to significant wealth, but it requires patience and time.

The Role of Luck and Risk: Luck and risk play significant roles in financial outcomes. Recognizing the impact of chance helps in understanding that not all success is purely due to skill, and not all failure is due to mistakes.

Tail Risks Matter: Rare events, or tail risks, can have a disproportionate impact on financial outcomes. Planning for unexpected events is crucial to long-term financial success.

The Importance of Saving: Saving is more about creating options, flexibility, and security than it is about purchasing power. It gives you the freedom to make choices that align with your values.

Avoid Lifestyle Creep: As income increases, there’s a tendency to increase spending, known as lifestyle creep. Avoiding this trap is key to building and maintaining wealth.

Time as a Currency: Controlling your time is one of the most valuable aspects of wealth. The freedom to do what you want, when you want, is the highest form of financial success.

Be Financially Unreasonable: Sometimes, making financial decisions that are technically irrational can lead to greater happiness and satisfaction. It’s okay to spend on things that bring joy, even if they don’t make perfect financial sense.

Plan for Surprises: No financial plan goes exactly as expected. Building in a margin of safety and being prepared for the unexpected is crucial for long-term financial health.

Wealth Is What You Don’t See: True wealth is not about flashy displays of money but the assets and security that you build behind the scenes. Living below your means is a hallmark of financial success.

Compounding: The idea that small, consistent investments grow exponentially over time. Housel emphasizes that the true power of compounding comes from patience and allowing investments to grow uninterrupted over long periods.

Behavioral Finance: Housel stresses that managing money is more about behavior than knowledge. Emotional factors like fear, greed, and personal experiences heavily influence financial decisions.

Tail Events: Rare, unpredictable events, often called “tail risks,” can have an outsized impact on financial markets and personal wealth. Planning for these events by building a margin of safety is crucial.

Margin of Safety: Having a buffer in your financial plan to absorb shocks from unexpected events. This concept is about planning for the unknown and ensuring that one’s financial plan is resilient to surprises.

Time Horizon: Understanding that different goals require different time horizons and that long-term thinking is essential for building wealth. The longer your time horizon, the more you can benefit from compounding and ride out market volatility.

Lifestyle Creep: The phenomenon where people’s spending increases as their income grows. Housel warns against this tendency, as it can prevent wealth accumulation and lead to financial stress.

Wealth vs. Riches: Wealth is what you don’t see—savings, investments, and financial security. Riches are often visible—luxury items, flashy purchases—but do not necessarily indicate financial health.

The Role of Luck and Risk: Success in finance often involves a mix of skill, luck, and risk. Recognizing the role of luck in success and the ever-present risk in financial decisions helps to maintain humility and caution.

Flexibility: The ability to adapt to changing circumstances is vital in finance. Financial plans should be flexible enough to accommodate unexpected life events, market changes, and personal shifts in goals or priorities.

Hindsight Bias: The tendency to view past events as having been predictable. Housel warns against this bias, emphasizing that many financial outcomes are influenced by unforeseeable factors, making humility and preparation key.

“Doing well with money isn’t necessarily about what you know. It’s about how you behave.”

“No one is crazy. Everyone makes decisions based on their own unique experiences that seem to make sense to them in a given moment.”

“Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

“The most important part of every plan is planning on your plan not going according to plan.”

“Wealth is what you don’t see. It’s the cars not purchased, the clothes not bought, the jewelry forgone, the first-class upgrade declined.”

“Controlling your time is the highest dividend money pays.”

“The ability to do what you want, when you want, with who you want, for as long as you want, pays the highest dividend that exists in finance.”

“There is no reason to risk what you have and need for what you don’t have and don’t need.”

“Compounding is the most powerful force in finance, but it only works if you can give it time to grow.”

“Getting wealthy and staying wealthy are two different skills.”

Behavior Over Knowledge: Success with money is more about behavior than technical knowledge. Good financial decisions are driven by discipline, patience, and self-control rather than just understanding numbers or strategies.

Compounding Power: Compounding is one of the most powerful forces in finance. Small, consistent investments over a long period can lead to significant wealth, but it requires patience and time.

The Role of Luck and Risk: Luck and risk play significant roles in financial outcomes. Recognizing the impact of chance helps in understanding that not all success is purely due to skill, and not all failure is due to mistakes.

Tail Risks Matter: Rare events, or tail risks, can have a disproportionate impact on financial outcomes. Planning for unexpected events is crucial to long-term financial success.

The Importance of Saving: Saving is more about creating options, flexibility, and security than it is about purchasing power. It gives you the freedom to make choices that align with your values.

Avoid Lifestyle Creep: As income increases, there’s a tendency to increase spending, known as lifestyle creep. Avoiding this trap is key to building and maintaining wealth.

Time as a Currency: Controlling your time is one of the most valuable aspects of wealth. The freedom to do what you want, when you want, is the highest form of financial success.

Be Financially Unreasonable: Sometimes, making financial decisions that are technically irrational can lead to greater happiness and satisfaction. It’s okay to spend on things that bring joy, even if they don’t make perfect financial sense.

Plan for Surprises: No financial plan goes exactly as expected. Building in a margin of safety and being prepared for the unexpected is crucial for long-term financial health.

Wealth Is What You Don’t See: True wealth is not about flashy displays of money but the assets and security that you build behind the scenes. Living below your means is a hallmark of financial success.

Compounding: The idea that small, consistent investments grow exponentially over time. Housel emphasizes that the true power of compounding comes from patience and allowing investments to grow uninterrupted over long periods.

Behavioral Finance: Housel stresses that managing money is more about behavior than knowledge. Emotional factors like fear, greed, and personal experiences heavily influence financial decisions.

Tail Events: Rare, unpredictable events, often called “tail risks,” can have an outsized impact on financial markets and personal wealth. Planning for these events by building a margin of safety is crucial.

Margin of Safety: Having a buffer in your financial plan to absorb shocks from unexpected events. This concept is about planning for the unknown and ensuring that one’s financial plan is resilient to surprises.

Time Horizon: Understanding that different goals require different time horizons and that long-term thinking is essential for building wealth. The longer your time horizon, the more you can benefit from compounding and ride out market volatility.

Lifestyle Creep: The phenomenon where people’s spending increases as their income grows. Housel warns against this tendency, as it can prevent wealth accumulation and lead to financial stress.

Wealth vs. Riches: Wealth is what you don’t see—savings, investments, and financial security. Riches are often visible—luxury items, flashy purchases—but do not necessarily indicate financial health.

The Role of Luck and Risk: Success in finance often involves a mix of skill, luck, and risk. Recognizing the role of luck in success and the ever-present risk in financial decisions helps to maintain humility and caution.

Flexibility: The ability to adapt to changing circumstances is vital in finance. Financial plans should be flexible enough to accommodate unexpected life events, market changes, and personal shifts in goals or priorities.

Hindsight Bias: The tendency to view past events as having been predictable. Housel warns against this bias, emphasizing that many financial outcomes are influenced by unforeseeable factors, making humility and preparation key.

Introduction

In a world increasingly driven by financial metrics and investment strategies, understanding the psychology behind money is more crucial than ever.

The Psychology of Money delves into how our emotions, biases, and personal experiences shape our financial decisions, often in ways we don’t fully comprehend.

Morgan Housel, with his insightful and engaging prose, unpacks the complex interplay between behavior and finance, offering timeless wisdom on how to approach money not just as a tool for wealth, but as a reflection of our deepest values and fears.

Through a series of compelling stories and practical lessons, this book reveals that the real key to financial success is not solely in the numbers but in understanding the human elements that drive our decisions.

Chapter 1: No One's Crazy

In the world of finance, every decision you make is influenced by your personal experiences, the way you were raised, and the economic environment you grew up in.

Imagine two people who lived through entirely different economic realities—one during the Great Depression and another during the 1990s tech boom.

Their approach to money would be vastly different, even if they were the same age.

This is the essence of why “No One’s Crazy” when it comes to money.

Key Takeaways

- Personal experiences drive financial behavior: The decisions people make with money aren’t necessarily rational or optimal—they’re deeply rooted in individual experiences.

- No universally correct approach: There’s no one “right” way to handle money. What seems reckless to one person might be completely logical to another based on their life experiences.

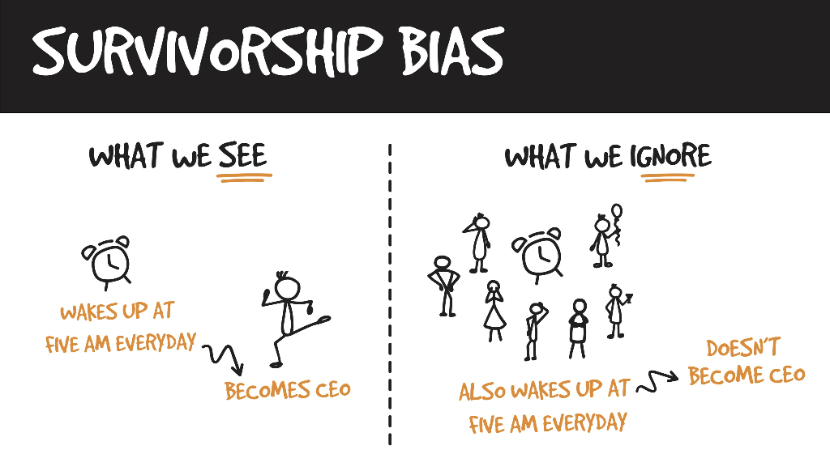

- Survivorship bias in financial advice: Most financial advice comes from successful people, but what worked for them may not work for you due to different circumstances.

Stories & Examples

- The Great Depression vs. The Tech Boom: Housel compares people who grew up during the Great Depression to those who came of age during the tech boom of the 1990s. While the former might hoard cash and avoid debt, the latter might embrace risk and investment. Neither approach is necessarily wrong—it’s just shaped by the environment each group experienced.

- Bill Gates and Kent Evans: Housel also shares the story of Bill Gates and his high school friend Kent Evans. Both were brilliant, but only one had the chance to become a billionaire. Evans died young in a mountaineering accident, illustrating how luck and circumstance play crucial roles in financial success.

Methodologies

- Understanding your personal money script: Reflect on your own experiences and how they’ve shaped your view on money. Are you more risk-averse, or do you seek out high-risk, high-reward opportunities? This self-awareness is key to making better financial decisions.

- Avoiding judgment of others’ financial choices: Recognize that others’ financial decisions are based on their unique experiences and are not necessarily irrational, even if they differ from your own approach.

Important Frameworks

- The “Three Sources of Wealth”: Housel explains that wealth comes from a combination of luck, risk-taking, and time. Understanding that luck plays a huge role can help temper our expectations and judgments about wealth accumulation.

- Survivorship Bias: The concept that successful outcomes are often overrepresented because failures are less visible. For instance, financial advice is often given by the wealthy, but their success stories are not always replicable due to different circumstances and a large role played by luck.

Chapter 2: Luck & Risk

Imagine two individuals standing at the edge of a vast field, both ready to embark on a journey.

One finds a path strewn with flowers, the other a rugged, uneven trail. Both paths lead to the same destination, but the experience and outcomes for these travelers will be entirely different.

This is how luck and risk shape our financial lives—unpredictable, often invisible forces that make a significant impact on where we end up, even when we think we’re in control.

Key Takeaways

- Luck and risk are inseparable: Success in finance often hinges on a combination of luck (favorable circumstances) and risk (unfavorable outcomes). Acknowledging the role of both is crucial to understanding financial outcomes.

- Success stories often ignore luck: Many success stories are told as if they are purely the result of skill or hard work, but often, luck plays a much bigger role than is acknowledged.

- Be humble in the face of uncertainty: Given the unpredictability of luck and risk, it’s important to remain humble and cautious in financial decision-making. Don’t assume past success will always translate into future results.

Stories & Examples

- Bill Gates and Kent Evans (revisited): Housel revisits the story of Bill Gates and Kent Evans. Gates, one of the wealthiest people in the world, and Evans, who had just as much potential but died young. Gates was lucky in avoiding the risks that took Evans’ life, underscoring how success is often as much about what doesn’t happen as it is about what does.

- The Russian Roulette analogy: Housel uses the metaphor of Russian Roulette to illustrate how success can be the result of avoiding disastrous risks rather than purely making good decisions. One person might win at Russian Roulette and think they were skilled when, in reality, they were just lucky to avoid a fatal outcome.

Methodologies

- Recognize the role of luck in your life: Reflect on your own successes and failures—how much of your achievements were influenced by factors outside your control? This understanding can help you stay grounded and avoid overestimating your abilities.

- Manage risk proactively: Since risk is an inherent part of financial decisions, it’s important to plan for it. Diversification, emergency funds, and conservative estimates can help you mitigate the potential downsides.

Important Frameworks

- The Luck and Risk Matrix: This framework emphasizes the intersection of luck and risk, encouraging individuals to map out potential outcomes based on varying levels of both. This can help you visualize the unpredictability of financial decisions and the importance of being prepared for a range of outcomes.

- Survivorship Bias (extended): Housel extends the discussion of survivorship bias by highlighting how we often only hear about the successful individuals who took risks and succeeded, while ignoring those who took the same risks and failed. This bias can lead to overestimating the likelihood of success in high-risk situations.

Chapter 3: Never Enough

Imagine climbing a mountain, each step taking you closer to the summit.

But as you near the top, you spot another peak in the distance, higher and more alluring.

Driven by ambition, you abandon your current path to chase the new goal. This is the dilemma many face with money—no matter how much they have, it never seems to be enough.

In this chapter, Housel explores the dangers of constantly moving the goalposts and the consequences of insatiable greed.

Key Takeaways

- The danger of insatiability: No amount of money will ever be “enough” if you’re constantly raising your expectations. This mindset can lead to endless dissatisfaction and poor decision-making.

- Contentment is key to financial happiness: Learning to appreciate what you have and setting realistic goals can lead to a more fulfilling financial life.

- Avoid the comparison trap: Comparing your wealth or success to others can lead to dangerous behavior, as it often pushes people to take unnecessary risks or adopt unsustainable lifestyles.

Stories & Examples

- Rajat Gupta’s downfall: Housel tells the story of Rajat Gupta, a successful business leader who had everything—wealth, power, and respect—but lost it all by engaging in insider trading. Despite having “enough,” Gupta’s greed for more led to his eventual imprisonment, serving as a stark warning about the dangers of never being satisfied.

- Vladimir Putin’s unquenchable thirst for power: Housel also draws a parallel to Russian President Vladimir Putin, whose pursuit of absolute power, despite already being one of the most powerful men in the world, has led to devastating consequences for millions of people. This illustrates how the desire for “more” can lead to irrational and destructive behavior.

Methodologies

- Define your own “enough”: Set clear, realistic financial goals that reflect your values and needs, rather than societal pressures or comparisons with others. Understanding what is “enough” for you personally can help avoid the trap of endless ambition.

- Practice gratitude and contentment: Regularly reflect on what you have and what you truly need. This mindset can foster a sense of contentment and reduce the urge to constantly pursue more.

Important Frameworks

- The Law of Diminishing Returns: This concept explains that beyond a certain point, additional wealth brings less and less satisfaction. Understanding this can help you realize when it’s time to stop chasing more and start enjoying what you have.

- The “Comparison Fallacy”: Housel warns against comparing your financial status to others. The fallacy lies in the fact that everyone’s financial journey is different, and comparisons often lead to feelings of inadequacy or irrational risk-taking.

Chapter 4: Confounding Compounding

Imagine a snowball rolling down a hill, gathering more snow with each turn.

What starts as a small ball soon grows into something massive, not because of any drastic changes in speed or direction, but simply due to the power of compounding.

This chapter explores the often-overlooked magic of compound interest—how small, consistent actions over time can lead to extraordinary results in the world of finance.

Key Takeaways

- Compounding is more powerful than you think: The true power of compounding lies in time. Even small returns can grow into significant wealth if given enough time, making patience one of the most important virtues in investing.

- Consistency over brilliance: You don’t need to be a financial genius to build wealth. Consistently saving and investing over a long period can often outperform more aggressive, high-risk strategies.

- Compounding applies to behavior as well: The benefits of good financial habits compound over time, just as poor habits can lead to significant negative consequences.

Stories & Examples

- Warren Buffett’s fortune: Housel highlights how Warren Buffett’s incredible wealth is largely due to the power of compounding. Buffett began investing at the age of 10, and by staying invested for decades, his wealth grew exponentially. Most of his net worth was accumulated after his 50th birthday, illustrating how compounding accelerates over time.

- Ronald Read’s simple strategy: The story of Ronald Read, a janitor and gas station attendant who amassed an $8 million fortune by consistently investing in blue-chip stocks and letting them compound over decades, shows that you don’t need a high income to build wealth—you need time and patience.

Methodologies

- Start early and be consistent: The earlier you start investing, the more time you give compounding to work its magic. Consistency in saving and investing, even in small amounts, can lead to substantial growth over time.

- Let your investments grow undisturbed: Avoid the temptation to frequently buy and sell investments. The real benefits of compounding come from allowing your investments to grow over the long term without interruption.

Important Frameworks

- The Compounding Curve: This framework illustrates how wealth grows slowly at first but accelerates dramatically over time. The longer you stay invested, the steeper the curve becomes, highlighting the exponential growth potential of compounding.

- The Patience Premium: Housel introduces the idea that patience in investing is often rewarded more than any particular stock-picking strategy. Those who can wait out market volatility and let their investments compound are often the ones who see the greatest returns.

Chapter 5: Getting Wealthy vs. Staying Wealthy

Building wealth and keeping it are two entirely different challenges.

Many people focus all their energy on growing their wealth but overlook the importance of protecting it.

This chapter dives into the crucial distinction between the strategies required to achieve wealth and those needed to preserve it, emphasizing the delicate balance between risk-taking and caution.

Key Takeaways

- Accumulating wealth requires risk-taking, but preserving it demands caution: While bold moves might be necessary to grow your wealth, maintaining that wealth often involves a more conservative approach.

- Survival is the key to long-term wealth: It’s not just about making money; it’s about staying in the game long enough to benefit from compounding and to avoid catastrophic losses.

- Understand the importance of tail risks: Major, unexpected events can wipe out wealth if you’re not prepared. Being aware of these risks and having safeguards in place is crucial.

Stories & Examples

- Jesse Livermore’s rollercoaster career: Housel recounts the story of Jesse Livermore, a famous stock trader who made and lost fortunes several times over. Livermore’s life illustrates how getting wealthy through bold decisions is only half the battle—without careful risk management, those gains can easily be lost.

- The fall of the Vanderbilt family: The Vanderbilt family, once one of the wealthiest in America, saw their fortune diminish over generations due to excessive spending and a lack of wealth preservation strategies. Their story serves as a cautionary tale about the importance of not just building wealth but also protecting it.

Methodologies

- Balancing risk and safety: As you grow your wealth, it’s essential to also build safeguards. This includes maintaining a diversified portfolio, having an emergency fund, and avoiding overexposure to high-risk investments.

- Focus on long-term survival: Make decisions that ensure you can withstand financial setbacks. Prioritizing steady, sustainable growth over risky, high-reward strategies can help ensure your wealth endures.

Important Frameworks

- The Barbell Strategy: This strategy involves dividing your investments between very safe and very risky assets. The majority of your wealth should be in low-risk, stable investments, while a smaller portion can be allocated to high-risk opportunities. This approach helps balance the potential for growth with the need for safety.

- Tail Risk Awareness: Recognize that extreme, rare events (tail risks) can have a massive impact on your wealth. Preparing for these events—through diversification, insurance, and conservative financial practices—can help protect against catastrophic losses.

Chapter 6: Tails, You Win

In the world of finance, not all successes are created equal. Some investments will fail, others will break even, and a few will become extraordinary successes that make up for all the losses.

The idea of “tail events”—those rare, extreme outcomes that have a massive impact—dominates this chapter.

Housel argues that understanding and embracing these tails is key to long-term financial success.

Key Takeaways

- A few big wins often drive most of your success: In investing, it’s common for a small number of decisions or investments to account for the majority of your gains. Recognizing this can help you focus on staying in the game rather than obsessing over every loss.

- Tails drive the financial world: Many of the greatest fortunes have been built on a few successful investments, while many failures fade into insignificance. It’s the rare, extreme events that often make the biggest difference.

- Patience and persistence are crucial: Given that tail events are unpredictable and infrequent, patience and the ability to stay invested over the long term are essential to capturing these rare opportunities.

Stories & Examples

- Amazon’s rise: Housel points to Amazon, which had many failures along its path to becoming a trillion-dollar company. Most of its new ventures and products didn’t succeed, but the few that did—like AWS—contributed enormously to its overall value. This example highlights how a few “tail” successes can outweigh numerous smaller failures.

- Venture capital success rates: In the venture capital world, it’s common for the majority of investments to fail or break even. However, a few exceptional successes can deliver such high returns that they cover all the losses and still generate significant profits.

Methodologies

- Embrace the unpredictability of tail events: Don’t be discouraged by frequent small losses or failures. Recognize that in investing, a few big wins will likely drive your overall success.

- Stay invested for the long term: Tail events are unpredictable, so the key is to remain invested over time. This increases your chances of being part of those rare, high-reward opportunities.

Important Frameworks

- The Power Law: This concept suggests that in many fields, including finance, a small number of events or participants account for the majority of outcomes. In investing, this means a few highly successful investments will typically generate most of your returns.

- Optionality in Investing: Housel emphasizes the value of maintaining “optionality”—keeping your options open by investing in a variety of opportunities that have the potential for outsized returns. This approach increases your likelihood of catching a tail event.

Chapter 7: Freedom

At its core, wealth isn’t just about having more money; it’s about having more freedom.

The ability to make choices that align with your values, to control your time, and to live life on your own terms—this is the true power of money.

In this chapter, Housel explores how financial freedom can lead to a more fulfilling life, and why it’s often the ultimate goal behind the pursuit of wealth.

Key Takeaways

- True wealth is the ability to control your time: The greatest benefit of wealth is freedom—specifically, the freedom to make decisions without being forced by financial constraints.

- Money can buy flexibility: Financial security allows you to navigate life with more options, whether it’s taking time off work, choosing the projects you care about, or simply reducing stress.

- The pursuit of freedom over status or material wealth: Prioritizing financial independence and the freedom it brings can lead to greater happiness than chasing status symbols or material possessions.

Stories & Examples

- The story of Richard Branson: Richard Branson, the founder of the Virgin Group, famously values freedom over traditional measures of success. His wealth has allowed him to live a life full of adventure, exploration, and personal fulfillment, rather than being tied down by conventional responsibilities. Branson’s life illustrates how wealth can be used to design a lifestyle based on personal values rather than societal expectations.

- The working class millionaire: Housel shares the story of a man who, despite being a millionaire, chooses to live a modest life with a focus on time spent with family and pursuing hobbies. His wealth affords him the freedom to live on his own terms, rather than being consumed by the need to accumulate more or impress others.

Methodologies

- Prioritize financial independence: Focus on building a financial cushion that gives you the freedom to make choices that align with your values, rather than being driven by the need to earn more money or achieve a higher status.

- Invest in flexibility: Instead of just accumulating wealth, consider how you can use your money to create more flexibility in your life. This might mean saving for a sabbatical, paying off debt to reduce financial stress, or investing in assets that generate passive income.

Important Frameworks

- The Time-Rich Framework: This framework encourages you to view wealth not just in terms of money, but in terms of the time and freedom it buys. It shifts the focus from accumulating more to maximizing the quality of the time you have.

- The Trade-Off Matrix: This concept involves weighing the trade-offs between money and freedom. It helps you evaluate decisions by considering not just the financial cost, but also the impact on your time and freedom, ensuring that your choices align with your broader life goals.

Chapter 8: Man in the Car Paradox

We often assume that flashy cars, luxury homes, and other symbols of wealth impress others and elevate our status.

However, Housel introduces the “Man in the Car Paradox,” which suggests that while we may believe these symbols make us look successful, in reality, most people don’t admire us for owning them—they imagine themselves in our place.

This chapter explores the psychology behind status symbols and why chasing them might not bring the validation we seek.

Key Takeaways

- People don’t think about you as much as you think: When others see you with a luxury item, they often don’t admire you for owning it; instead, they think about how they would feel owning it themselves.

- Status symbols rarely deliver the validation we expect: Chasing material symbols of wealth might make you feel successful temporarily, but it often doesn’t lead to lasting happiness or respect.

- Focus on internal satisfaction rather than external validation: True fulfillment comes from personal achievements and values, not from the perception of others.

Stories & Examples

- The man in the luxury car: Housel recounts a story where he observed a man driving an expensive sports car. Rather than being impressed by the driver’s wealth, Housel realized he was imagining what it would be like if he were the one driving the car. This moment highlighted the paradox—people admire the object, not the owner.

- The millionaire next door: Housel references studies and stories of millionaires who live modestly and focus on financial independence rather than flashy displays of wealth. These individuals often find more satisfaction in their financial security than in the approval of others.

Methodologies

- Shift focus from appearance to substance: Instead of investing in status symbols, invest in things that bring you real joy or security, like experiences, relationships, or financial freedom.

- Internalize your sources of validation: Reflect on what truly matters to you and focus on achieving personal goals rather than seeking external approval.

Important Frameworks

- The Status vs. Satisfaction Dichotomy: This framework helps differentiate between actions taken to boost one’s status and those that genuinely increase personal satisfaction. It encourages prioritizing decisions that lead to internal happiness over those meant to impress others.

- The Hedonic Treadmill: Housel touches on this concept, which explains how people quickly return to a baseline level of happiness after acquiring new possessions. Understanding this can help you avoid the trap of constantly chasing the next material upgrade for temporary satisfaction.

Chapter 9: Wealth is What You Don’t See

Wealth isn’t always about the things you can buy; often, it’s about the things you don’t buy.

This chapter delves into the idea that true wealth is invisible—hidden in the form of investments, savings, and financial security.

Housel argues that while flashy displays of wealth might catch the eye, the most important aspects of wealth are those that remain unseen.

Key Takeaways

- Wealth is hidden: The money you don’t spend, the investments you hold, and the financial security you build are all parts of wealth that others can’t see. True wealth is more about what you have in reserve than what you display.

- Living below your means is a key to building wealth: By not spending everything you earn, you create a buffer that allows your wealth to grow and protects you against future uncertainties.

- Financial independence comes from what you don’t spend: The power of wealth lies in the freedom it can give you, and this freedom often comes from your ability to save and invest rather than from spending on luxuries.

Stories & Examples

- The invisible millionaire: Housel shares the story of a man who lived modestly despite being a millionaire. His wealth was not visible in expensive cars or luxury items but in his investments and savings. This man’s story illustrates that true wealth is often unrecognized because it’s not flaunted.

- The fallacy of visible wealth: The author describes the common mistake of assuming that those with flashy lifestyles are truly wealthy. In reality, many of these people are living paycheck to paycheck, using credit to fund their lifestyles, while those with substantial wealth often live more quietly and below their means.

Methodologies

- Focus on saving and investing: Prioritize building your financial reserves through consistent saving and smart investing. This invisible wealth will provide you with security and options in the future.

- Avoid lifestyle inflation: Resist the urge to increase your spending as your income grows. Instead, maintain or even lower your living expenses to build more wealth over time.

Important Frameworks

- The Savings Rate: This framework emphasizes the importance of the percentage of your income that you save. The higher your savings rate, the faster you can build wealth and the more financial security you’ll have.

- The “Hidden Wealth” Concept: Housel introduces the idea that much of true wealth is hidden in assets that are not immediately visible, such as stocks, bonds, real estate, or retirement accounts. This framework helps to shift focus from visible luxury to long-term financial security.

Chapter 10: Save Money

Saving money might seem like a basic principle, but it’s one of the most powerful tools for building and maintaining wealth.

In this chapter, Housel explores the critical role of saving in achieving financial success and security, emphasizing that saving is not just about reducing expenses but about creating a foundation for future opportunities and stability.

Key Takeaways

- Saving money creates financial options: The ability to save provides you with flexibility and opportunities, enabling you to take advantage of investments, weather financial setbacks, and pursue personal goals.

- Savings are a buffer against uncertainty: Having a substantial savings cushion helps protect you from unforeseen expenses and financial emergencies, reducing stress and providing peace of mind.

- The impact of saving is often underestimated: While saving may seem like a small or mundane action, it has a compounding effect over time and plays a crucial role in wealth accumulation.

Stories & Examples

- The tale of the frugal engineer: Housel recounts the story of an engineer who lived well below his means despite a high salary. His disciplined saving and investing allowed him to retire early and live comfortably, illustrating how consistent saving can lead to significant financial freedom.

- The downfall of overspending: Housel also discusses examples of individuals who, despite high earnings, failed to save adequately and faced financial difficulties later in life. Their experiences highlight how the lack of saving can erode wealth and financial stability.

Methodologies

- Adopt a saving mindset: Treat saving as a non-negotiable habit rather than an optional activity. Prioritize saving by setting aside a portion of your income before considering discretionary spending.

- Automate your savings: Implement automatic transfers to savings accounts or investment funds to ensure that saving becomes a regular part of your financial routine, reducing the temptation to spend.

Important Frameworks

- The Savings Rate Formula: This framework involves calculating the percentage of your income that is saved and invested. Monitoring and increasing this rate can help you gauge your progress toward financial goals and long-term security.

- The Emergency Fund Model: Housel emphasizes the importance of having an emergency fund that covers several months of living expenses. This fund acts as a financial safety net, protecting you against unexpected expenses and providing a buffer during economic downturns.

Chapter 11: Reasonable > Rational

In finance, being perfectly rational is often considered the ideal, but this chapter argues that being reasonable is usually more practical and beneficial.

Housel explores the difference between strict rationality and reasonable decision-making, emphasizing that making financial decisions that fit your personal circumstances and goals is more important than adhering to purely logical principles.

Key Takeaways

- Reasonable decisions align with personal values: Making financial choices that are reasonable and aligned with your values and circumstances often leads to better outcomes than adhering to strict rationality.

- Rationality can be impractical: While rational financial models and theories can be precise, they often don’t account for personal preferences, emotional factors, and real-world constraints.

- Focus on what works for you: Instead of striving for perfect rationality, aim to make decisions that are sensible and manageable within your unique situation.

Stories & Examples

- The story of the “average” investor: Housel discusses how average investors who make reasonable decisions—like diversifying investments and avoiding excessive risk—often outperform those who strictly follow theoretical models but ignore personal circumstances.

- The practical wisdom of Warren Buffett: Housel highlights Warren Buffett’s approach, which blends rational analysis with practical wisdom. Buffett’s reasonable strategies, such as focusing on long-term value and avoiding unnecessary risks, illustrate how practical decision-making can lead to sustained success.

Methodologies

- Apply the 80/20 rule: Focus on the most impactful aspects of your financial strategy rather than striving for perfection. The Pareto Principle (80/20 rule) suggests that 80% of results come from 20% of efforts. Apply this principle by prioritizing key financial decisions that will yield the most significant benefits.

- Consider your personal context: When making financial decisions, take into account your personal values, goals, and constraints. Ensure that your decisions are reasonable within the context of your life rather than strictly following theoretical models.

Important Frameworks

- The Rational vs. Reasonable Model: This framework helps differentiate between decisions based solely on logic and those that consider personal circumstances and practicalities. It encourages balancing rational analysis with personal reasonableness to achieve better outcomes.

- The Margin of Safety Principle: Originating from Benjamin Graham, this principle involves making decisions with a buffer to account for uncertainty and personal factors. It emphasizes reasonable risk management over strict rationality.

Chapter 12: Surprise!

Life is full of unexpected events that can significantly impact financial outcomes. In this chapter, Housel explores the role of surprises—both positive and negative—in financial planning and decision-making.

Understanding and preparing for the unexpected can help manage risks and seize opportunities that arise from unforeseen circumstances.

Key Takeaways

- Unexpected events shape financial outcomes: Both positive and negative surprises can have a substantial impact on your financial situation. Being prepared for these events can mitigate risks and capitalize on opportunities.

- Flexibility is key: Financial plans should be adaptable to accommodate unforeseen changes. Rigid plans may not withstand the shocks of unexpected events, so flexibility and resilience are crucial.

- Prepare for the unknown: While it’s impossible to predict every surprise, having a solid financial foundation and emergency strategies can help you handle unexpected events more effectively.

Stories & Examples

- The tech startup success story: Housel describes a tech startup that thrived due to a sudden surge in demand for its services, illustrating how unexpected positive events can lead to substantial financial gains. The company’s ability to adapt quickly contributed to its success.

- The impact of a market crash: An example of an individual whose retirement plans were significantly affected by an unforeseen market downturn highlights the importance of having a contingency plan and financial buffer to handle negative surprises.

Methodologies

- Build a robust emergency fund: Establish a financial cushion to cover unexpected expenses and income disruptions. This fund helps you navigate negative surprises without derailing your financial stability.

- Incorporate flexibility in your financial planning: Develop adaptable financial strategies that can be adjusted based on changing circumstances. Avoid overly rigid plans that may not accommodate unexpected developments.

Important Frameworks

- The Scenario Planning Framework: This framework involves creating different scenarios of potential surprises and developing strategies to handle them. It helps in preparing for a range of possible outcomes and enhancing financial resilience.

- The Contingency Planning Model: This model focuses on preparing backup plans for various unexpected events, ensuring that you have strategies in place to manage both positive and negative surprises.

Chapter 13: Room for Error

In “Room for Error,” Housel emphasizes the importance of building a margin of safety into your financial plans.

This chapter discusses how having a buffer or cushion can help absorb the impact of unexpected events and mistakes, ultimately allowing you to take calculated risks without jeopardizing your financial well-being.

Key Takeaways

- Always plan with a margin of safety: Incorporating a buffer into your financial plans helps protect against the unexpected, whether it’s an economic downturn, a personal financial crisis, or an investment that doesn’t pan out as expected.

- Avoid over-optimism: While optimism is important, overestimating your financial prospects or underestimating risks can lead to trouble. A margin of safety helps counterbalance this by preparing for less favorable outcomes.

- The power of staying in the game: The longer you stay financially stable, the more likely you are to succeed. A margin of safety ensures you can endure setbacks without being forced out of the market or your financial goals.

Stories & Examples

- The cautious investor: Housel shares a story of an investor who, instead of chasing the highest returns, consistently built a margin of safety into his investments. When markets turned volatile, his conservative approach allowed him to avoid significant losses and stay invested for the long term.

- The story of housing debt: Another example involves homeowners who borrowed heavily during the housing boom. When the market crashed, those without a margin of safety in their finances faced foreclosure, while those with a buffer were able to weather the storm.

Methodologies

- Build an emergency fund: An essential part of creating a margin of safety is having an emergency fund that covers at least 3-6 months of living expenses. This fund acts as a financial cushion during tough times.

- Adopt conservative assumptions: When planning for the future, use conservative estimates for things like investment returns, income growth, and expenses. This conservative approach helps ensure that even if things don’t go as planned, you won’t be caught off guard.

Important Frameworks

- The Margin of Safety Framework: This framework involves incorporating a buffer in your financial plans to protect against potential risks and uncertainties. It’s a core principle in both investing and personal finance to ensure long-term stability.

- The Conservative Forecasting Model: This model encourages using conservative estimates and assumptions in financial planning to build resilience against adverse scenarios. It’s especially useful in managing investments, retirement planning, and large financial commitments.

Chapter 14: You’ll Change

In “You’ll Change,” Housel discusses how people’s financial goals, values, and circumstances inevitably evolve over time.

This chapter explores the importance of recognizing that your current priorities and plans may not align with your future self, and how flexibility and adaptability are crucial in long-term financial planning.

Key Takeaways

- Expect change in your goals and priorities: As you age, your values and what you want out of life will likely shift. Financial plans should be flexible enough to accommodate these changes.

- Avoid rigid financial commitments: Long-term commitments that don’t allow for flexibility can become burdensome as your goals and circumstances change. Maintaining some degree of financial flexibility ensures that you can adjust to life’s inevitable changes.

- Plan for multiple futures: Since it’s impossible to predict exactly how your future self will think or feel, planning for various potential scenarios can help you stay prepared and aligned with your evolving priorities.

Stories & Examples

- The evolving career path: Housel shares the story of someone who planned for a lifetime career in one field but found their interests and passions shifting over time. By maintaining financial flexibility, they were able to pivot into a new career without significant financial strain.

- Changing retirement goals: Another example involves a couple who originally planned to retire early but later decided to work longer due to changes in their health, family dynamics, and personal interests. Their ability to adjust their financial plan allowed them to accommodate their new goals.

Methodologies

- Create adaptable financial plans: Design your financial plans with the understanding that your goals and circumstances will likely change. Build in options and flexibility so you can adjust your plans as needed.

- Regularly reassess your goals: Periodically review and update your financial goals and plans to ensure they still reflect your current values and future aspirations.

Important Frameworks

- The Flexibility Framework: This framework emphasizes the importance of keeping financial plans adaptable to accommodate changes in your life. It involves regularly reassessing your goals and making adjustments to stay aligned with your evolving priorities.

- The Multi-Scenario Planning Model: This model involves planning for different potential futures, recognizing that your preferences and circumstances may change. It encourages creating financial strategies that remain robust across various scenarios.

Chapter 15: Nothing’s Free

In “Nothing’s Free,” Housel emphasizes that every financial decision comes with a cost, even if it’s not immediately obvious.

This chapter explores the hidden trade-offs in various financial choices and the importance of recognizing that every benefit has a price, whether it’s in terms of risk, time, or opportunity.

Key Takeaways

- Every benefit has a hidden cost: Whether it’s financial returns, lifestyle upgrades, or career success, there’s always a price to be paid. Understanding these costs helps you make more informed decisions.

- Risk and reward are inseparable: Higher returns or greater rewards often come with higher risks. Accepting this relationship is key to managing expectations and making sound financial choices.

- Beware of opportunity costs: When you choose one financial path, you often give up another. Being aware of these opportunity costs ensures that you’re making the best possible decisions with your resources.

Stories & Examples

- The investor’s dilemma: Housel shares a story about an investor who chased high returns without fully understanding the associated risks. When the market turned, the investor faced significant losses, illustrating the cost of ignoring the risk-reward trade-off.

- The cost of career success: Another example involves a professional who achieved great success in their career but at the expense of personal relationships and health. This story highlights the hidden costs of prioritizing one aspect of life over others.

Methodologies

- Conduct a cost-benefit analysis: Before making financial decisions, thoroughly evaluate both the visible and hidden costs, including risks and opportunity costs. This analysis helps ensure that you understand the true price of your choices.

- Balance risk and reward: Develop a financial strategy that aligns with your risk tolerance and long-term goals. Avoid chasing high rewards without fully considering the risks involved.

Important Frameworks

- The Risk-Reward Framework: This framework helps you assess the balance between potential rewards and associated risks in financial decisions. It encourages a realistic approach to evaluating investment opportunities and other financial choices.

- The Opportunity Cost Model: This model emphasizes considering what you’re giving up when making a financial decision. It ensures that you’re aware of the trade-offs and can choose the path that best aligns with your priorities.

Chapter 16: You and Me

Personal financial decisions are often influenced by societal expectations and comparisons with others.

This chapter explores how the interplay between individual choices and social pressures can impact financial behavior and well-being.

Housel examines the importance of understanding and managing these influences to make decisions that align with your true values and goals.

Key Takeaways

- Social comparisons drive financial behavior: Many financial decisions are influenced by comparisons with peers, leading to spending or saving choices based on societal expectations rather than personal needs.

- Understand your personal values: It’s essential to differentiate between what you genuinely want and what you feel pressured to achieve based on social norms. Aligning financial decisions with your own values leads to greater satisfaction and financial health.

- Beware of the “keeping up with the Joneses” mentality: Striving to match or exceed the financial status of others can lead to overspending and financial stress. Focus on your own goals and values rather than societal benchmarks.

Stories & Examples

- The pressure of lifestyle inflation: Housel recounts stories of individuals who increased their spending as their income rose to match their peers’ lifestyles. This “keeping up with the Joneses” approach often results in financial strain and a lack of long-term financial security.

- The minimalist approach to wealth: Conversely, Housel describes people who consciously choose to live modestly despite having substantial wealth. Their decisions are guided by personal values rather than social pressures, leading to greater financial contentment.

Methodologies

- Conduct a values assessment: Regularly reflect on your personal values and goals to ensure that your financial decisions align with them rather than with social expectations or peer pressures.

- Set personal financial goals: Define and pursue financial goals based on what is meaningful to you, not what you perceive others expect or achieve. This approach fosters a more authentic and satisfying financial journey.

Important Frameworks

- The Social Comparison Framework: This model helps you analyze how comparisons with others influence your financial decisions. By understanding these influences, you can make more informed choices that reflect your true priorities rather than external pressures.

- The Personal Values Alignment Model: This framework involves aligning financial decisions with personal values and long-term goals. It encourages assessing whether financial behaviors are driven by genuine needs or by societal expectations.

Chapter 17: The Seduction of Pessimism

Pessimism often captures more attention than optimism, particularly in the financial world where caution and risk management are crucial.

This chapter explores why pessimism can be more seductive than optimism and how it affects decision-making and perception in investing and personal finance.

Key Takeaways

- Pessimism attracts more attention: Negative news and pessimistic views often seem more compelling and urgent than optimistic ones, which can skew perceptions and decision-making in finance.

- Long-term success relies on optimism: While caution is necessary, maintaining a fundamentally optimistic outlook is crucial for long-term success. Optimism helps drive investments and innovations that lead to growth and positive outcomes.

- Beware of confirmation bias: Pessimism can reinforce confirmation bias, where people selectively focus on information that supports their negative outlook, ignoring more balanced or positive data.

Stories & Examples

- The Great Depression’s impact on investment behavior: Housel discusses how the pervasive pessimism during the Great Depression led to widespread financial caution and missed opportunities for long-term gains. The era’s focus on risk aversion overshadowed potential growth.

- The tale of tech booms and busts: The tech industry’s history shows cycles of optimism and pessimism. During the dot-com bubble, extreme optimism led to overvaluations, while the subsequent bust was fueled by severe pessimism, affecting market behavior and investment strategies.

Methodologies

- Balance pessimism with optimism: While it’s important to be cautious, balance your outlook by considering both risks and opportunities. Avoid letting pessimistic views overshadow potential positive outcomes and growth opportunities.

- Focus on long-term trends: Emphasize long-term trends and fundamentals rather than short-term negative news. This approach helps maintain a balanced perspective and supports better investment decisions.

Important Frameworks

- The Optimism-Pessimism Spectrum: This framework helps in assessing your outlook on investments and financial decisions. It encourages maintaining a balance between healthy caution and optimism to make well-rounded decisions.

- The Confirmation Bias Model: Understanding how confirmation bias affects your financial decisions can help in actively seeking out balanced information and avoiding overly negative or positive viewpoints.

Chapter 18: When You’ll Believe Anything

In “When You’ll Believe Anything,” Housel examines the power of narratives in shaping our financial beliefs and decisions.

This chapter delves into how stories and simplified explanations can sometimes lead to misguided beliefs and how critical thinking is crucial in financial decision-making.

Key Takeaways

- Narratives can be misleading: People often believe financial stories that are compelling, even if they are oversimplified or inaccurate. These narratives can lead to distorted perceptions of risk, opportunity, and financial reality.

- Critical thinking is essential: Questioning and critically analyzing the stories and explanations you encounter can help you avoid falling into the trap of believing overly simplistic or incorrect financial narratives.

- Complexity vs. Simplicity: Financial decisions are often complex, and while simple explanations are appealing, they can overlook important nuances. Embracing the complexity of financial matters can lead to better decision-making.

Stories & Examples

- The dot-com bubble: Housel discusses how the narrative of the “new economy” during the dot-com boom led many investors to believe that traditional financial rules no longer applied. This belief contributed to a speculative bubble and eventual market crash, illustrating the dangers of blindly following popular financial narratives.

- The myth of the self-made billionaire: Another example addresses the common narrative that successful entrepreneurs are entirely self-made. Housel highlights how this story often ignores the roles of luck, timing, and external factors, which are critical to understanding the full picture.

Methodologies

- Question the narrative: Whenever you encounter a popular financial story or explanation, take the time to question its validity. Look for evidence that supports or contradicts the narrative and consider alternative explanations.

- Embrace complexity: Recognize that financial decisions often involve many variables and resist the temptation to oversimplify. Being comfortable with complexity can lead to more nuanced and informed financial choices.

Important Frameworks

- The Narrative Bias Framework: This framework helps you identify and analyze the influence of compelling narratives on your financial beliefs and decisions. It encourages a critical approach to evaluating stories and the assumptions they create.

- The Complexity Embrace Model: This model advocates for accepting and understanding the complexity of financial situations. It promotes thorough analysis over simplistic conclusions, leading to more sound financial decision-making.

Chapter 19: All Together Now

In “All Together Now,” Housel synthesizes the various lessons discussed throughout the book into a cohesive summary.

This chapter emphasizes the importance of integrating these principles into your overall financial philosophy, helping you navigate the complexities of money management with a balanced and informed approach.

Key Takeaways

- Combine the lessons: The key to successful financial management is not just understanding individual principles but combining them into a holistic approach that guides your decisions.

- Balance is crucial: Financial success requires balancing different, often conflicting, principles—like optimism and caution, planning and flexibility, risk and safety.

- Continuous learning and adaptation: The financial landscape is always changing, and staying informed while being open to new ideas and approaches is essential for long-term success.

Stories & Examples

- The seasoned investor: Housel shares the story of an investor who, over decades, learned to balance various financial principles—such as risk management, patience, and flexibility—to build lasting wealth. This story highlights the importance of integrating different lessons into a unified approach.

- The financially content retiree: Another example is of a retiree who successfully combined lessons from the book to achieve financial security and contentment. By focusing on what truly mattered to them and maintaining balance, they were able to enjoy their retirement without financial stress.

Methodologies

- Develop a holistic financial plan: Incorporate the various principles discussed throughout the book into your financial planning. This means balancing risk with caution, short-term needs with long-term goals, and flexibility with discipline.

- Regularly revisit and refine your approach: As your circumstances change, regularly assess and adjust your financial plan to ensure it remains aligned with both the lessons you’ve learned and your evolving goals.

Important Frameworks

- The Integrated Financial Philosophy Framework: This framework helps you synthesize different financial principles into a cohesive strategy. It emphasizes balance, continuous learning, and adaptation to guide your financial decisions.

- The Holistic Planning Model: This model advocates for viewing financial planning as an ongoing process that integrates various principles, such as risk management, savings, investment, and personal fulfillment, into a comprehensive strategy.

Chapter 20: Confessions

In “Confessions,” Housel shares personal reflections on his own financial journey, including the mistakes he’s made and the lessons he’s learned along the way.

This chapter offers a candid look at how even experts struggle with the same challenges and emotions that affect everyone else when it comes to money.

Key Takeaways

- Everyone makes mistakes: Even financial experts are not immune to errors in judgment. Acknowledging and learning from your mistakes is key to growing and improving your financial decisions.

- Humility in finance: Recognizing the limits of your knowledge and the uncertainty inherent in financial markets can help you approach money with the right mindset—one of humility and continuous learning.

- The importance of personal values: Financial decisions should align with your personal values and life goals, rather than being driven solely by external expectations or market trends.

Stories & Examples

- Housel’s investing mistakes: Housel candidly discusses some of his own investing mistakes, such as chasing high returns and underestimating risks. These experiences taught him the value of patience, risk management, and the importance of sticking to a long-term strategy.

- The lesson of contentment: Housel reflects on how, over time, he realized that contentment and financial security mattered more to him than accumulating vast wealth. This shift in perspective helped him make financial decisions that were more in line with his personal values.

Methodologies

- Reflect on your financial journey: Regularly take time to reflect on your own financial decisions, both the successes and the mistakes. This practice can help you learn from the past and make better choices in the future.

- Align financial decisions with personal values: Ensure that your financial choices support your broader life goals and personal values, rather than just being focused on maximizing wealth.

Important Frameworks

- The Reflection and Learning Framework: This framework encourages regular self-reflection on your financial decisions, helping you learn from past mistakes and successes. It’s a tool for continuous improvement and personal growth in your financial life.

- The Values-Driven Decision Model: This model focuses on aligning financial decisions with your core values and life goals. It helps ensure that your financial strategy not only meets your economic needs but also supports your overall well-being.

Book FAQs

The Psychology of Money explores the psychological and emotional aspects of financial decision-making. Rather than focusing on technical financial strategies, the book examines how behavior, biases, and personal experiences influence how people think about and manage money.

This book is ideal for anyone interested in personal finance, regardless of their level of expertise. It’s especially valuable for those who want to understand the behavioral factors that drive financial decisions and how to approach money management with a more thoughtful and balanced mindset.

Unlike many finance books that focus on investment strategies or economic theories, The Psychology of Money delves into the human side of finance—how emotions, psychology, and personal values influence financial behavior. It combines storytelling with practical lessons, making complex concepts accessible and relatable.

Housel defines wealth not as visible signs of riches (like luxury cars or expensive homes) but as what you don’t see—savings, investments, and financial security. True wealth is about financial freedom and the ability to control your time.

One of the most important lessons is that financial success is about managing behavior—being patient, disciplined, and humble—more than having technical knowledge or skills. The ability to avoid impulsive decisions and stay the course over time is crucial for building and maintaining wealth.

In “The Psychology of Money,” Housel emphasizes that understanding and managing risk is crucial to financial success. He discusses how many financial decisions are influenced by the fear of loss and how building a margin of safety can help protect against unforeseen events and downturns.

The Psychology of Money teaches that financial independence is about more than just accumulating wealth. It’s about creating the freedom to live life on your own terms, control your time, and make choices that align with what truly matters to you.

Absolutely. “The Psychology of Money” is highly relevant in today’s financial climate as it addresses timeless principles of behavior, risk management, and decision-making that apply regardless of market conditions. Housel’s insights are particularly valuable during times of uncertainty and economic volatility.

The Psychology of Money debunks the myth that financial success is purely about knowledge and strategy. Housel argues that managing money well is more about how you behave—your patience, humility, and emotional control—than about how much you know or how smart you are.

Recap of "Zero to One" by Peter Thiel

Behavior Over Knowledge:

- Housel argues that financial success is more about behavior—patience, discipline, and self-control—than technical knowledge.

- Emotional factors like fear, greed, and personal experiences heavily influence financial decisions.

Power of Compounding:

- Compounding is highlighted as a powerful tool for building wealth, where small, consistent investments grow exponentially over time.

- Housel stresses the importance of time and patience in allowing compounding to work effectively.

Luck and Risk:

- Success in finance often involves a mix of skill, luck, and risk. Recognizing the role of luck helps maintain humility, while acknowledging risk ensures caution.

- The book underscores that not all success is due to skill, and not all failure is due to mistakes.

Tail Events and Margin of Safety:

- Rare, unpredictable events (tail risks) can have a significant impact on financial outcomes. Planning for these events is crucial.

- Housel introduces the concept of a margin of safety—a buffer in financial planning to absorb shocks from unexpected events.

Time Horizon and Long-Term Thinking:

- Different financial goals require different time horizons. Long-term thinking is essential for riding out market volatility and benefiting from compounding.

- Housel advocates for patience and staying the course, even when short-term outcomes are unfavorable.

Wealth vs. Riches:

- Housel distinguishes between wealth and riches—wealth is what you don’t see, such as savings and financial security, while riches are visible, like luxury items.

- True wealth is about achieving financial freedom and security, not just accumulating material possessions.

Lifestyle Creep:

- As income increases, there’s a natural tendency to increase spending (lifestyle creep), which can prevent wealth accumulation.

- Housel advises resisting lifestyle creep to build and maintain financial security.

Flexibility and Adaptability:

- The ability to adapt to changing circumstances is key in finance. Financial plans should be flexible enough to handle unexpected life events or market changes.

- Being open to change and adjusting plans as needed is crucial for long-term success.

Hindsight Bias and Humility:

- Housel warns against hindsight bias, the tendency to see past events as predictable, which can lead to overconfidence.

- Humility is emphasized as a vital trait in finance, acknowledging that we can’t predict everything and must prepare for uncertainty.

Control Over Time:

- One of the most valuable aspects of wealth is the ability to control your time—choosing how to spend your days without financial constraints.

- Housel views time freedom as the ultimate financial goal, more valuable than money itself.

Values-Driven Financial Decisions:

- Financial decisions should align with personal values and long-term life goals, rather than being driven by external pressures or trends.

- Housel encourages making financial choices that bring fulfillment and contentment, rather than simply pursuing wealth for its own sake.

Continuous Learning:

- The financial landscape is always changing, so continuous learning and adapting are essential for long-term success.

- Housel emphasizes the importance of staying informed and being willing to adjust your financial approach as needed.

You may also like these

Read. Grow. One Book at a Time.

Become smarter and knowledgeable with non-fiction books. Delivered straight to your inbox. 3-5 mins read. Twice a week.

Continue your learning

Read. Growth. One Book at a Time.

Become smarter and knowledgeable with non-fiction books. Delivered straight to your inbox. 3-5 mins read. Twice a week.